Risk has always been a fundamental aspect of business. But one of the most significant and possibly misunderstood risks that businesses face today is climate change. It is understood that continuing rise in emissions will lead to more damage to the environment with social and economic impacts, but the exact timing and severity of these effects are hard to predict.

As a result of this, climate consciousness and reporting has not always been a top priority for businesses, but this is starting to change. Investors and governments are increasingly expecting action from companies to monitor and reduce their carbon emissions.

For many investors, climate change poses significant financial risk – the expected transition to a lower-carbon economy is estimated to require around $1 trillion of investments a year for the foreseeable future. At the same time, the physical risks of climate change and the transition risk of implementing new technologies may affect businesses even more. In fact, a 2015 study estimated that, of the global stock of manageable assets, the value at risk as a result of climate change ranges from $4.2 trillion to $43 trillion between now and the end of the century.

To help identify the information needed by investors, lenders, and insurance underwriters to appropriately assess and price climate-related risks and opportunities, the Financial Stability Board established an industry-led task force: the Task Force on Climate-related Financial Disclosures (TCFD). The Task Force developed eleven recommendations around four themes: governance, strategy, risk management and metrics & targets.

These recommendations are designed to solicit decision-useful, forward-looking information that can be included in mainstream financial filings. The Task Force also identified two major categories of risk: physical risks and transition risks.

As Temperatures Rise, Risk Grows

To understand physical risk, all you need to do is look at weather-related headlines from the past year. Heat waves, floods and wildfires have been more frequent and more intense. The UK has experienced record breaking heatwaves, with temperatures breaking 40 degrees for the first time in history. The losses associated with these weather events, both social and economical – no wonder investors are demanding more accessible and transparent assessments on the physical risks that companies face.

When we think of physical risk, we typically think of the headline weather events that end up in our news feeds – acute risk. Longer-term shifts in climate patterns – chronic risk – rarely make headlines but are just as problematic. For example, findings from WWF found that rising sea levels caused by climate change place £12bn of the UK’s economy at risk.

While storm surge is linked to hurricanes and tropical storms that draw media attention, the slow pace of sea-level rise relegates it to scientific journals and smaller audiences. Businesses with operations in any coastal location cannot afford to ignore it.

Climate Change Demands a Transition

The potential impacts of climate change on organisations, however, are not only physical. To stem the disastrous effects of climate change within this century, nearly 200 countries agreed in December 2015 to reduce greenhouse gas emissions and accelerate the transition to a lower-carbon economy.

The reduction in greenhouse gas emissions implies movement away from fossil fuel energy and related physical assets. This, coupled with rapidly declining costs and increased use of clean and energy-efficient technologies could have significant, imminent financial implications for organisations dependent on extracting, producing, and using coal, oil, and natural gas.

In order to achieve this, companies need to understand and adapt to the effects of climate change that we’re experiencing and we will continue to experience in the coming years. They also have to assess how their operations contribute to global warming and climate change.

Both assessments are leading to a revision of existing business models, development of new technologies, and driving innovation. And it’s from these developments that transition risk emerges.

The Bank of England explains how the required response to climate change causes transition risk.

Transition risk is complex, and it can elicit a glass-half-full or glass-half-empty attitude and approach. Because, while changes associated with a transition to a lower-carbon economy present significant risk, they also create significant opportunities for organisations focused on climate change mitigation and adaptation solutions. Consider companies that rely on single-use plastics: How are they adapting to the bans that countries are imposing on these plastics? Will they be able to identify and tap opportunities as they contend with these bans? If they can’t, other entrepreneurs and companies will.

Whether a company can turn transition risks into opportunity or not, investors—and now regulators—want to know how companies intend to respond to them. In fact, 73% of investors believe efforts to help improve the environment contribute to return.

Risk Management Now Includes Physical Risk and Transition Risk

Business leaders know that risk management looks different now. Challenges focus on the systemic risks that climate change poses, as well as the predictable risks, that come with an unforeseeable impact, such as increasingly volatile weather patterns. Underlying this framework in the recognition that any changes made now will directly impact the scale and nature of future risks, adding another layer of complexity. Frameworks like TCFD provide a foundation to improve investors’ and others’ ability to appropriately assess and price climate-related risk and opportunities. The Task Force’s recommendations aim to be ambitious, but also practical for near-term adoption.

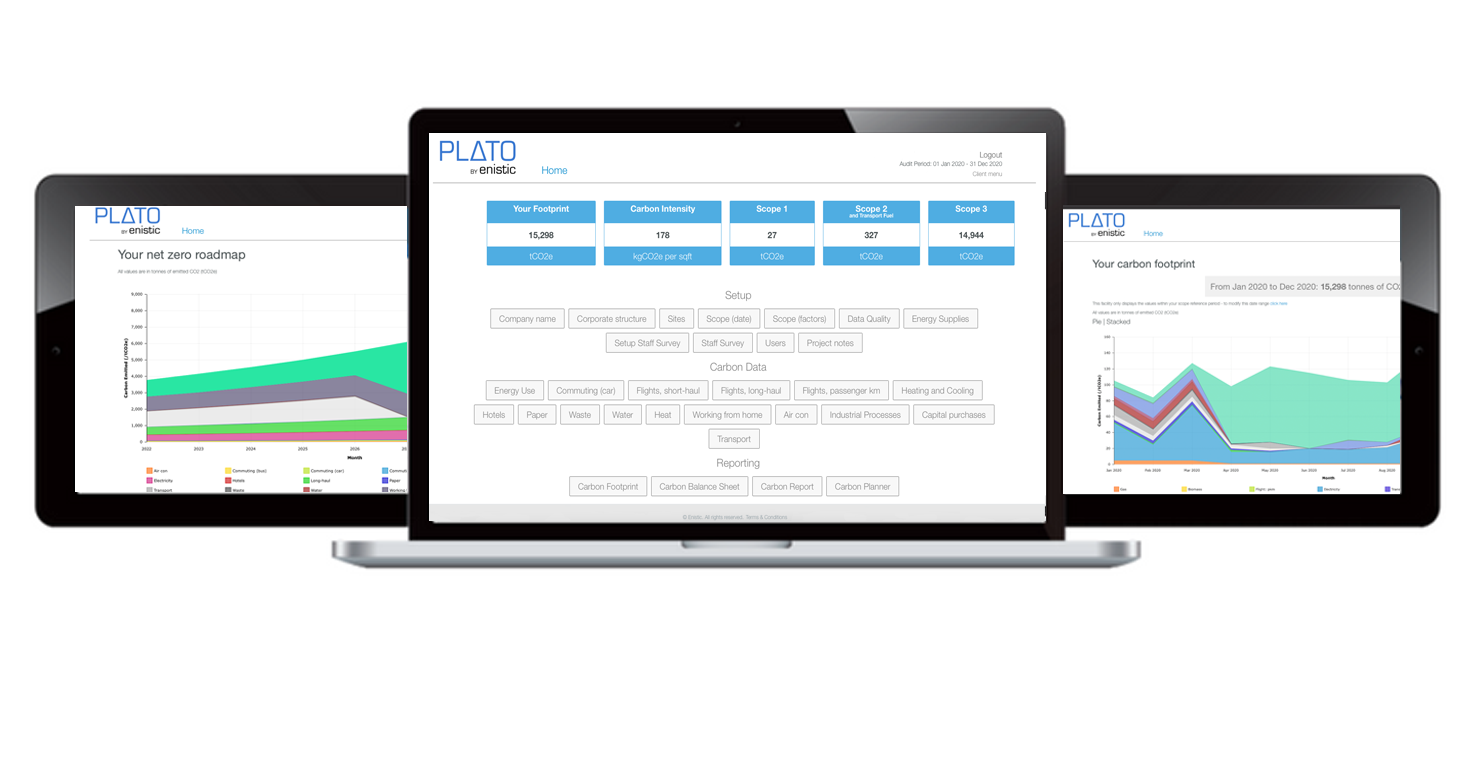

Find out more about how Enistic can help with TCFD reporting below.

The Enistic Platform

Our cloud-based carbon management platform pulls together your carbon data into one, easy-to-access place. Intuitive dashboards help you to visualise key metrics, and monitor performance at a glance. The built in analytics suite enables you to create customisable reports that can be exported and shared with your organisation. Download reports and share your carbon data and progress easily.

• Live carbon Footprint Trace

• Report your progress to stakeholders

• Up-to-date conversion factor

• Analyse and compare individual sites

• Contact Enistic’s experts for specialist support

• Downloadable and customisable reports

Book a free consultation

Contact one of our Net-Zero experts today and book a free consultation to see how Enistic can help you set your Net Zero strategy. We will make the processing time and cost-effective. ensuring you move forward, informed, empowered, and confident that you have control.